It’s been nearly half a century since humans left footprints on the moon and during that time, human space exploration has largely centered on manned low-Earth orbit missions and unmanned scientific exploration. But now, high levels of private funding, advances in technology, and growing public-sector interest are renewing the call to look toward the stars.

The investment implications for a more accessible, less expensive reach into outer space could be significant, with potential opportunities in fields such as satellite broadband, high-speed product delivery and perhaps even human space travel. While the most recent space exploration efforts have been driven by handful of private companies, the establishment of a sixth branch of the U.S. military in 2019—the “Space Force”—along with growing interest from Russia and China, means public-sector investment may also increase in the coming years.

To outline progress in space from both public and private companies, as well as government efforts, the Space team at Morgan Stanley Research has been examining these developments to detail the constellation of potential opportunities for investors.

2020: A Space Odyssey

A single transformative technology shift often can spark new eras of modernization, followed by a flurry of complimentary innovations. In 1854, when Elisha Otis demonstrated the safety elevator, the public couldn’t foresee its impact on architecture and city design. But roughly 20 years later, every multistory building in New York, Boston, and Chicago was constructed around a central elevator shaft.

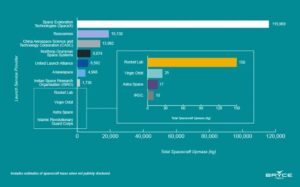

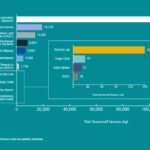

Today, development of reusable rockets may provide a similar turning point. “We think of reusable rockets as an elevator to low Earth orbit (LEO),” says Morgan Stanley Equity Analyst Adam Jonas. “Just as further innovation in elevator construction was required before today’s skyscrapers could dot the skyline, so too will opportunities in space mature because of access and falling launch costs.”

Privately held space exploration firms have also been developing space technologies, with ambitions such as manned landings on the moon and airplane-borne rocket launchers that could launch small satellites to LEO at a far lower cost, and with far greater responsiveness, than ground-based systems.

Growing Public-Sector Interest

While private-equity projects have grabbed most of the headlines in recent years, public-sector interest has also grown. In December of 2019, the Trump Administration established a U.S. Space Command (including a Space Operations Force and a Space Development Agency) with the signing of the as part of the National Defense Authorization Act for 2020. This development will likely benefit the U.S. Defense Department—as well as the aerospace and defense industries—and help focus and accelerate investment in innovative technologies and capabilities.

Then in May of 2020, NASA launched a manned flight to the International Space Station (ISS) on a commercially developed U.S. rocket. The launch represented the first time that the U.S. has flown a manned mission to the ISS since the shuttle program was retired in 2011. It also represents an important milestone for the relationship between private enterprise and the U.S. government in the space domain.

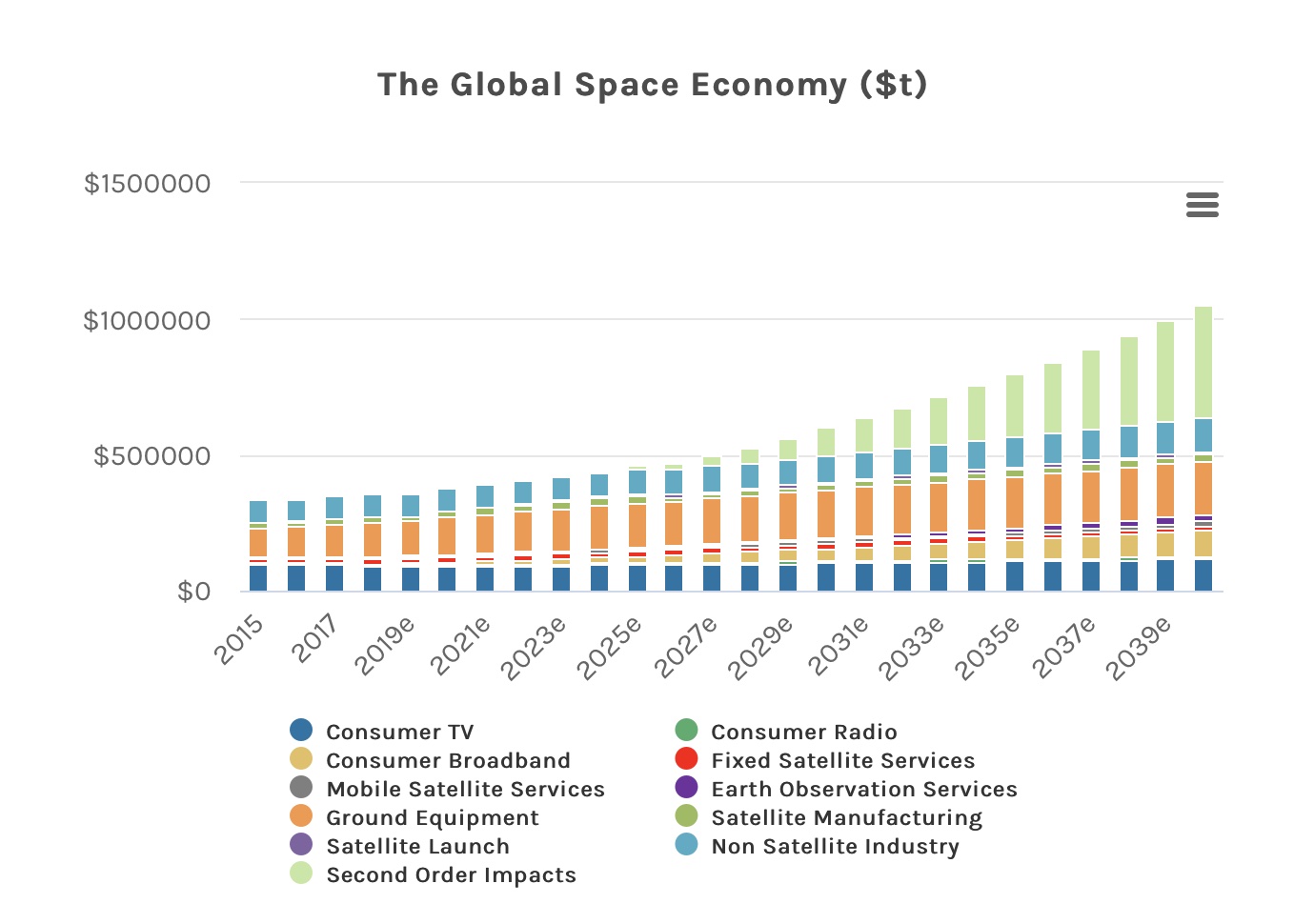

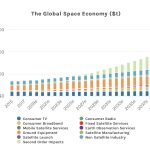

Stanley Morgan: The Global Space Economy

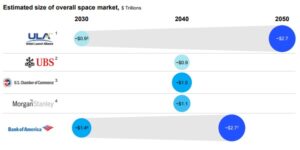

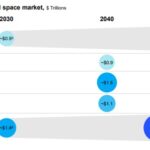

Near term, space as an investment theme is also likely to impact a number of industries beyond Aerospace & Defense, such as IT Hardware and Telecom sectors. Morgan Stanley estimates that the global space industry could generate revenue of more than $1 trillion or more in 2040, up from $350 billion, currently. Yet, the most significant short- and medium-term opportunities may come from satellite broadband Internet access.

Morgan Stanley estimates that satellite broadband will represent 50% of the projected growth of the global space economy by 2040—and as much as 70% in the most bullish scenario. Launching satellites that offer broadband Internet service will help to drive down the cost of data, just as demand for that data explodes.

In fact, as data demand surges—a trend driven particularly by autonomous vehicles—Morgan Stanley estimates that the per-megabyte cost of wireless data will be less than 1% of today’s levels.

While reusable rockets will help drive those costs down, so too will the mass-production of satellites and the maturation of satellite technology. Currently, the cost to launch a satellite has declined to about $60 million, from $200 million, via reusable rockets, with a potential drop to as low as $5 million. And satellite mass production could decrease that cost from $500 million per satellite to $500,000.

Stanley Morgan: To Infinity and Beyond

Beyond the opportunities generated by satellite broadband Internet, the new frontiers in rocketry offer some tantalizing possibilities. Packages today delivered by airplane or truck could be delivered more quickly by rocket. Perhaps private space travel could become commercially available. Mining equipment could be sent to asteroids to extract minerals—all possible, theoretically, with the recent breakthroughs in rocketry.

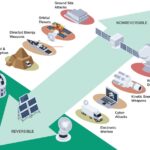

Jonas cautions that “history is littered with cautionary tales” of investing in satellite and other space-related companies, noting that stocks have been volatile and several such companies failed in the 1990s. Understandably, many investors would rather think about nearer-term themes that are actionable and can impact their portfolios in 2020. However, initiatives by large public and private firms suggest that space is an area where we will see significant development, potentially enhancing U.S. technological leadership and addressing opportunities and vulnerabilities in surveillance, mission deployment, cyber, and artificial intelligence.

READ THE WHOLE ARTICLE AT STANLEY MORGAN WEBSITE (Click)